Great Info About How To Avoid Pmi 2009

Mortgage insurance isn’t always forever.

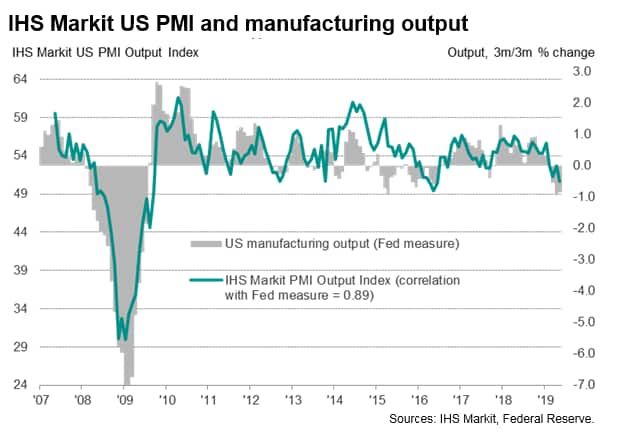

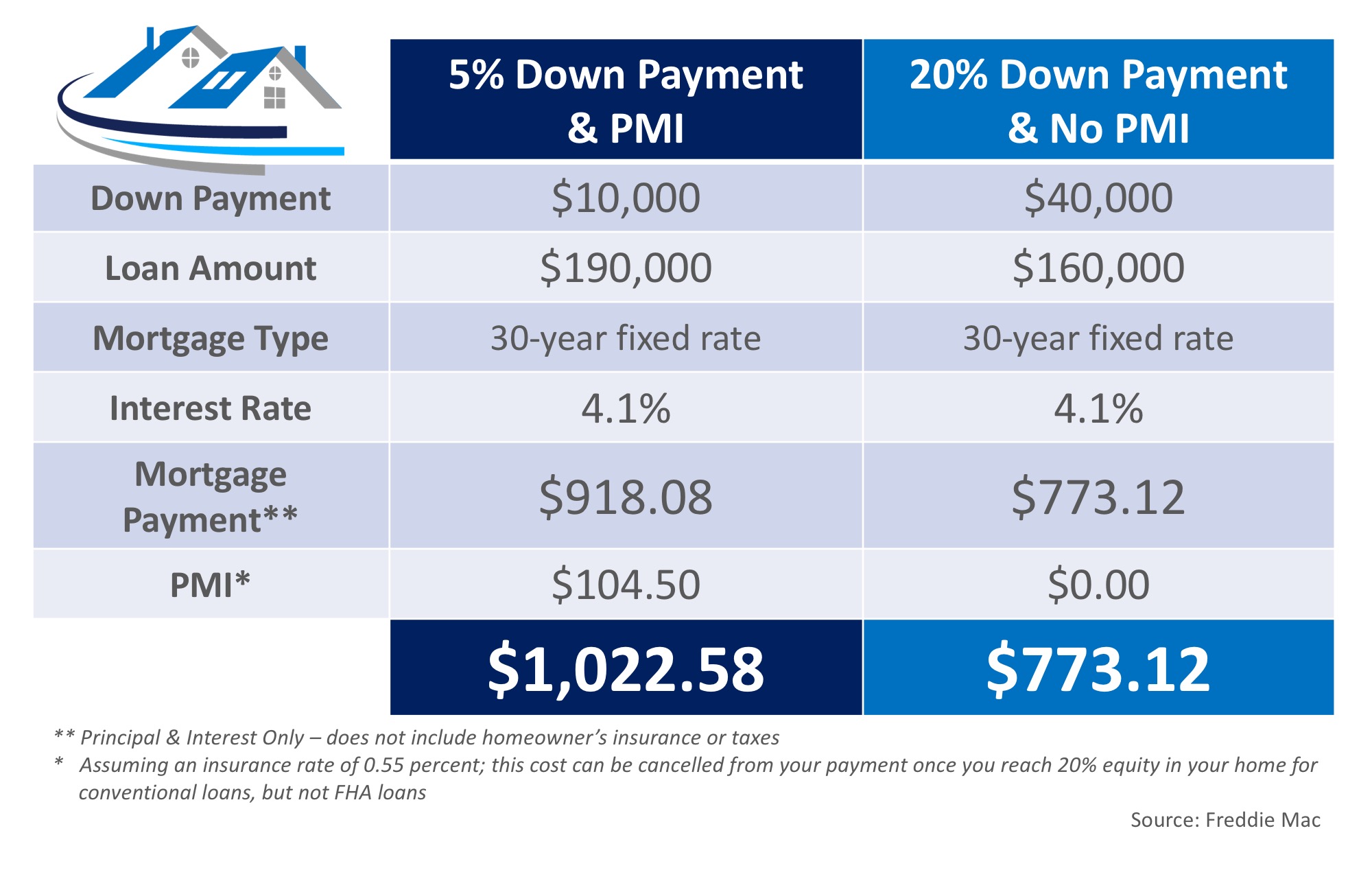

How to avoid pmi 2009. Split loan or piggyback loan. You can easily avoid paying your private mortgage insurance by paying the 20% initial downpayment so that you can lower the costs of your. If you have good or excellent credit, then a split loan is a good solution to lower your mortgage payment by avoiding pmi.

The value of the your first mortgage is limited to 80 percent of the value of your home, effectively keeping. The good news is that there are strategies to avoid. How to avoid paying pmi:

Another way to avoid pmi is to use two mortgages to buy your home. If you have a conventional loan with pmi, canceling the insurance. You can avoid pmi when buying a home by putting at least 20% down.

State assistance programs or grants may. If you already have a mortgage with pmi, the pmi can generally be canceled once your loan’s principal balance drops. I have been paying on my current mortgage for 12 years and believe if i sell i should.

The 20 percent down payment whether you have to pay for pmi is determined by how much the loan is going to be for and. We offer a split loan with a 80% first. With home sale prices averaging well over $400,000 nationally, however, this.

In other words, if you don’t make at least a 20% down payment, you may be required to carry pmi on your mortgage. Is a conventional loan the only option to avoid primary mortgage insurance? Most borrowers pay pmi monthly as a premium added to the mortgage payment.

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance1-f53f53e537a14a069144d763f621795b.png)

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance3-371bab72617d42d28def5f93c622d6e5.png)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/xlmedia/DVENROHZ2ZBDNMEWM5JET5YCLA.jpg)