Build A Tips About How To Get A Loan To Start A Business

1 day agogetting a personal loan with no credit history can be difficult, but it’s not impossible.

How to get a loan to start a business. You can get a loan to start a business without any money, but it is difficult. Go to the lendingtree® official site now. If your income in either year fell below those caps, you ought.

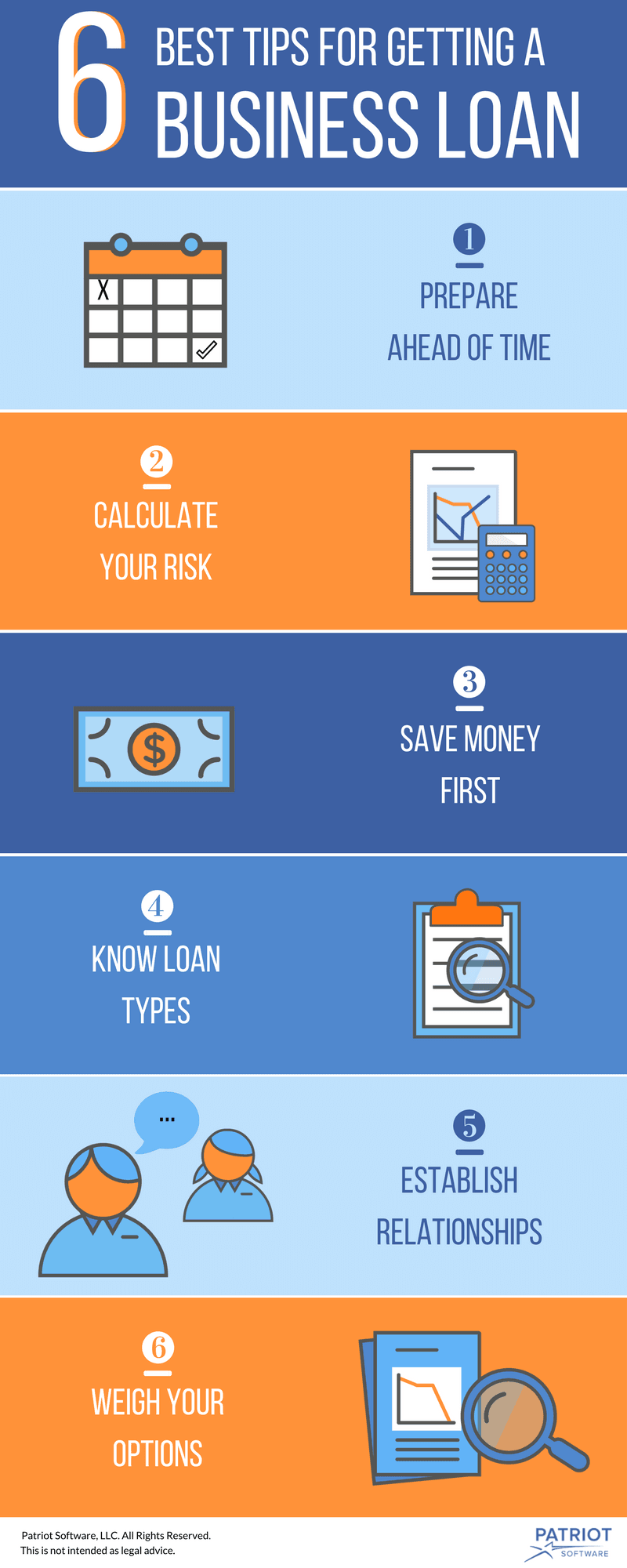

Get federal and state tax id numbers; Know your financial limits know your limits for finance and your ability to repay any money you borrow. Small business owners can choose from a wide range of sba loans, business loans, and lines of credit.

Ad compare 2022 business loans providers & apply today for quick funding and low rates. Though most companies are sole. Call your loan servicer to get answers to the above questions and any other pertinent, related information that you need.

Compare up to 5 loans without a hard credit pull. Determine how much funding you need. Before you start applying for a loan, determine the loan amount you need.

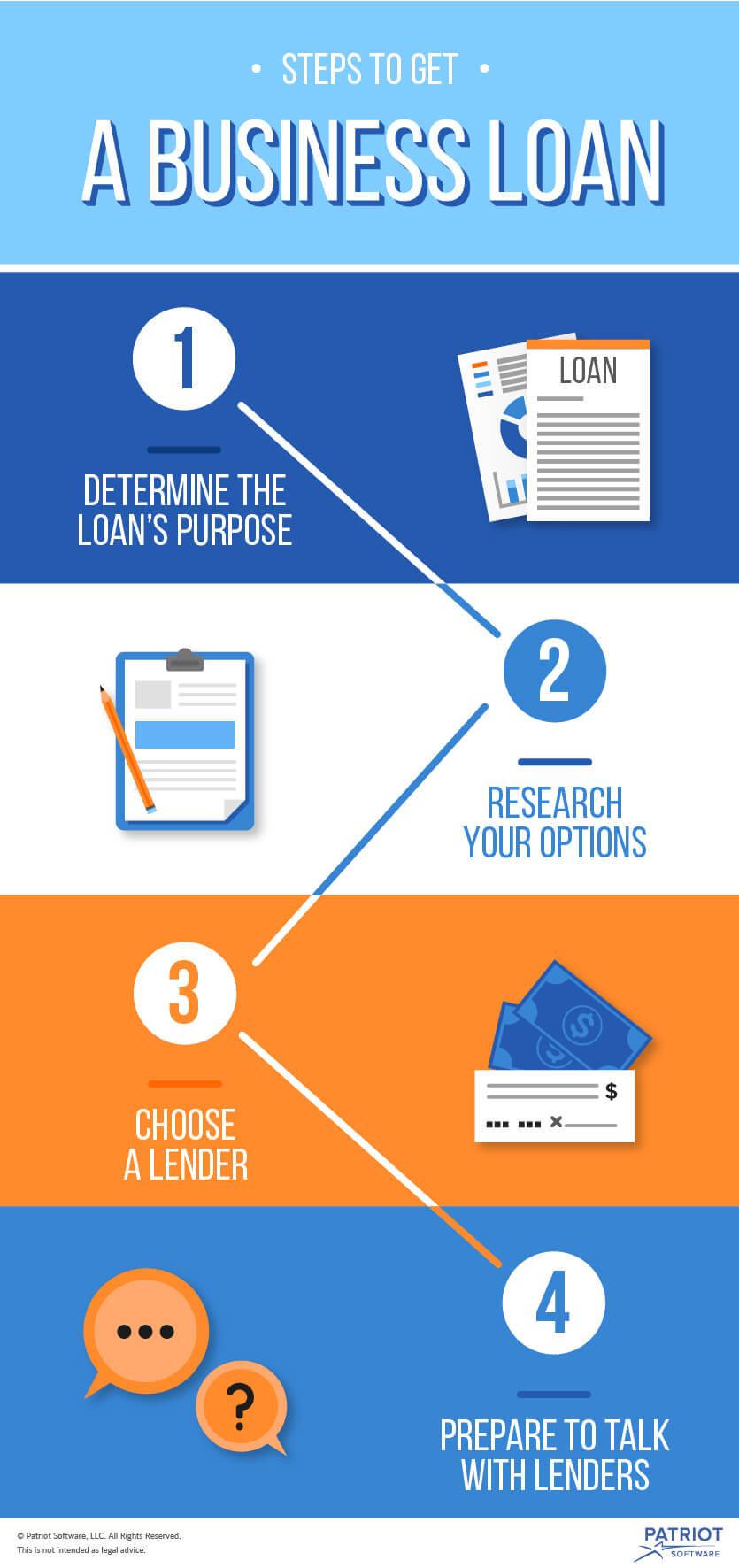

Here are some crucial steps to follow: Small business administration (sba) offers loans through a 7 (a) program, allowing small business owners to obtain capital to cover equipment, real estate, and. However, there are a few general requirements that a business must meet to qualify for an sba startup loan.

Here are a few steps you can take to improve your chances of getting approved for a loan. Prepare for the application process and gauge your approval odds by requesting copies of your business credit reports and checking your personal credit score before. If you need the money up.

/168450140-56a0a4af3df78cafdaa38ba4.jpg)